Achieving energy access (SDG7) while tackling climate change (SDG13): Learnings and next steps post a proof-of-concept implementation

It is a global responsibility to end energy poverty through access to clean, affordable and sustainable energy, whilst tackling climate change. Energy access acts as a catalyst for the growth of developing societies and economies. Yet, clean energy still remains inaccessible for a significant portion of the global population (~840m people live in the off-grid regions, and ~1bn people have unreliable grid access, as of 2019[1]).

The challenges concerning this can be broken down into the following:

- A significant financing gap exists to fuel the energy-access sector enterprises and the necessary ecosystem around it. It is estimated that a total of $33 billion in blended capital will be required to achieve UN SDG7 by 2030[2]. An additional $1bn of softer early-stage funding support is required to generate a pipeline of companies that can absorb commercial investment.

- A considerable segment of the true low-income customers simply do not have enough income to afford even the most economical of solar home system products or services and cannot admittedly be served without any form of government/donor subsidy.

- Finally, often several off-grid solar PAYG (Pay as you go) customers who initially can afford such solutions may have these solutions repossessed or locked out due to temporary or seasonal changes to incomes. Whilst off-grid solar enterprises need to maintain their commercial goals to achieve sustainability and scale, customer incomes are highly sensitive even to small changes such as seasonality, rainfall, harvests and loss of key household incomes through employment or mortality. It is a serious challenge for these households and a sad fact of today’s reality, despite their willingness and need for energy access.

Climate markets provide an emerging opportunity for potentially new hitherto-untapped financing streams for the off-grid energy, or the distributed renewable energy (DRE) sector. Governments as well as the private sector around the world are beginning to price carbon. Within global trading schemes alone, $57bn[3] per year is invested by governments and the private sector into green finance and climate solutions. However, there are several market barriers or market failures that are preventing the realisation of the full potential that carbon markets offer. For example, looking at the carbon pricing, currently roughly 50% of all the current schemes under the Voluntary market[4] are priced under $1/tCO2e. World Bank estimates that in order to meet the Paris accord target of a <2°C future the carbon prices need to rise to $50-$100/tCO2e by 2030[5]. Looking further from the energy access lens, it is estimated that African markets constitute only 4% of all Clean Development Mechanism (CDM) projects (compliance market), most likely due to the lack of the enabling ecosystem and mechanism to efficiently track carbon displacement in those markets.

Some specific market barriers that underscore the above trends and restrict the use of existing climate finance specifically for the DRE sector players such as Bboxx are:

- Regulations: The complex regulatory environment in compliance carbon markets are prohibitive for distributed energy companies. Whilst few certification methodologies exist for distributed energy products, these are not designed for the volume the off-grid sector provides, and also tend to be prohibitive with legacy processes in place.

- Transaction costs: The current methodology includes manual reporting and auditing, and for a widely distributed project it can be nearly impossible sometimes to have an accurate and credible data sets.

- Low carbon prices: Off-grid solar projects yield relatively small amounts of emission reductions as compared to utility-scale renewable projects or nature-based offsetting intervention options. Therefore, the cost to generate corresponding carbon offsets simply exceeds the economic benefit of availing the carbon finance.

These trends highlight a significant opportunity to unlock the climate market potential which is consistent with the broader climate change dialogue (SDG7 linked to SDG13). Bboxx, SouthPole and SF are committed towards finding and testing solutions that can unlock such market potential while aiming to attain sustainable energy for all.

The Opportunity for ‘DDIG’ – Unlocking Climate Finance Through Digitisation

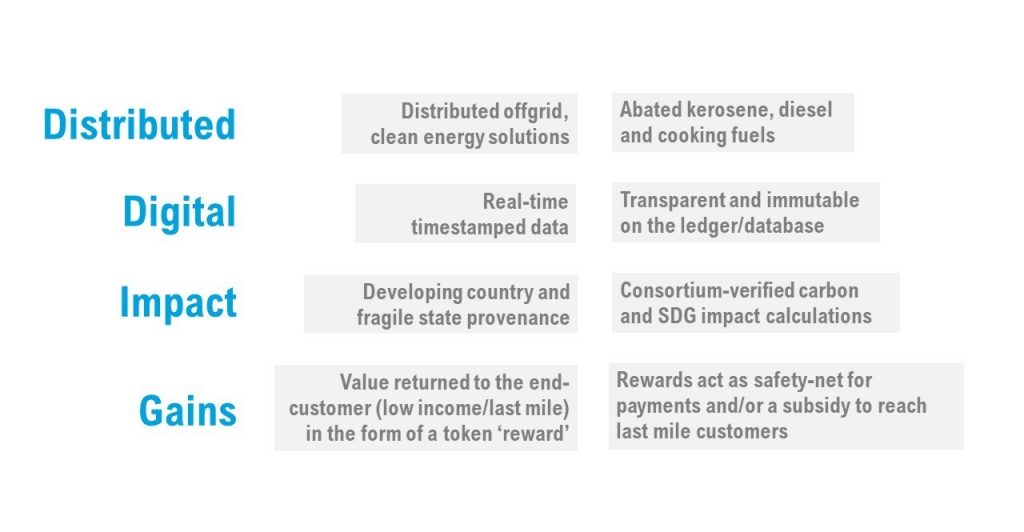

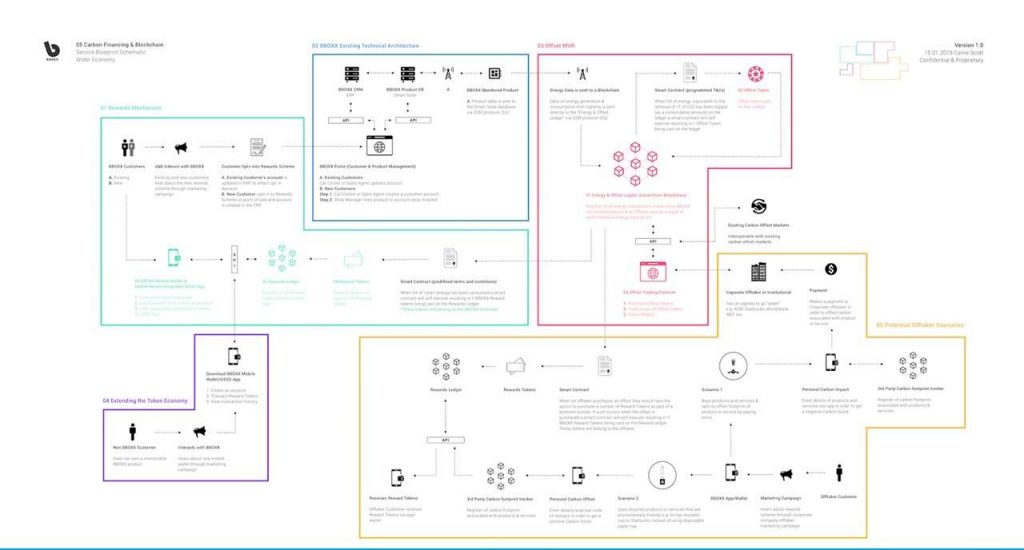

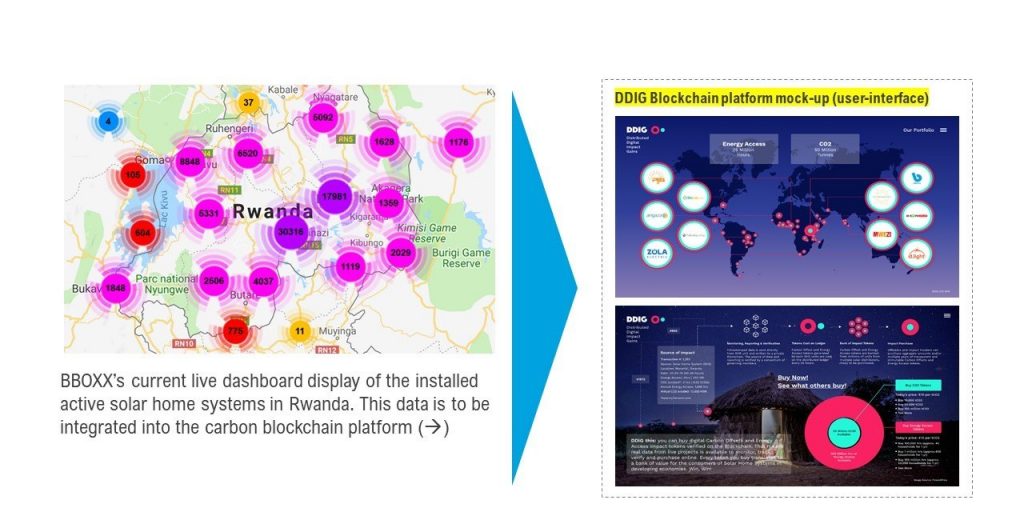

Over the course of 2019, Bboxx, South Pole, IBM and SF, supported by the UK government, came together as a joint multi-stakeholder team to study, design and develop a novel approach that aims to attract new sources of climate finance (SDG13) towards the achievement of sustainable energy for all (SDG7). The concept is coined DDIG, or Distributed Digital Impact Gains.

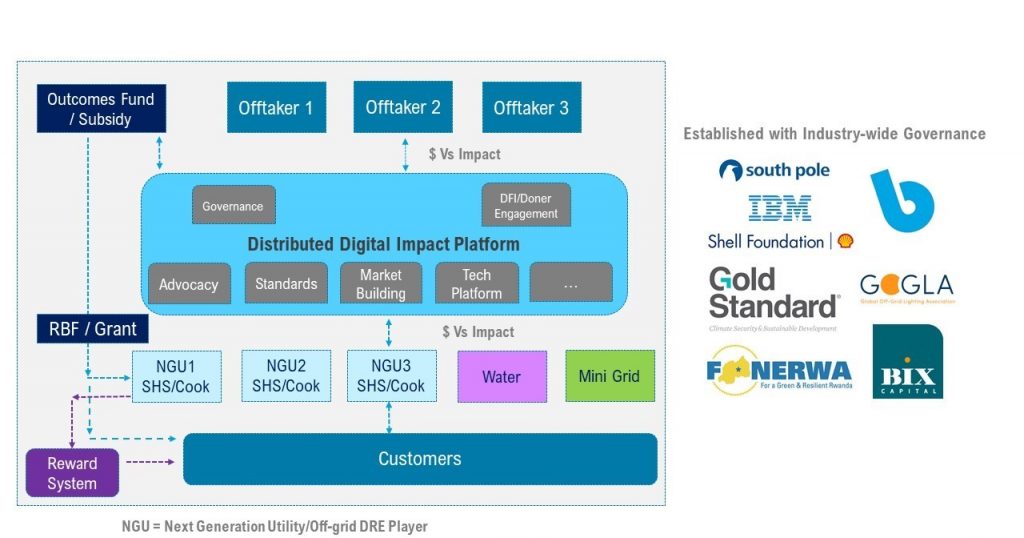

DDIG is conceptualised as a digital platform which is aimed to capture real-time data from remotely monitored energy projects on blockchain and translates it to environmental values. It could substantially reduce transaction costs by automating the monitoring, reporting and verification process (MRV) to reward end customers in developing countries. The platform intent is to be a public good rather than an exclusive to one player – open to a wide group of distributed energy players, as well as variety of sectors such as water and LPG supply to impact livelihoods of the less privileged.

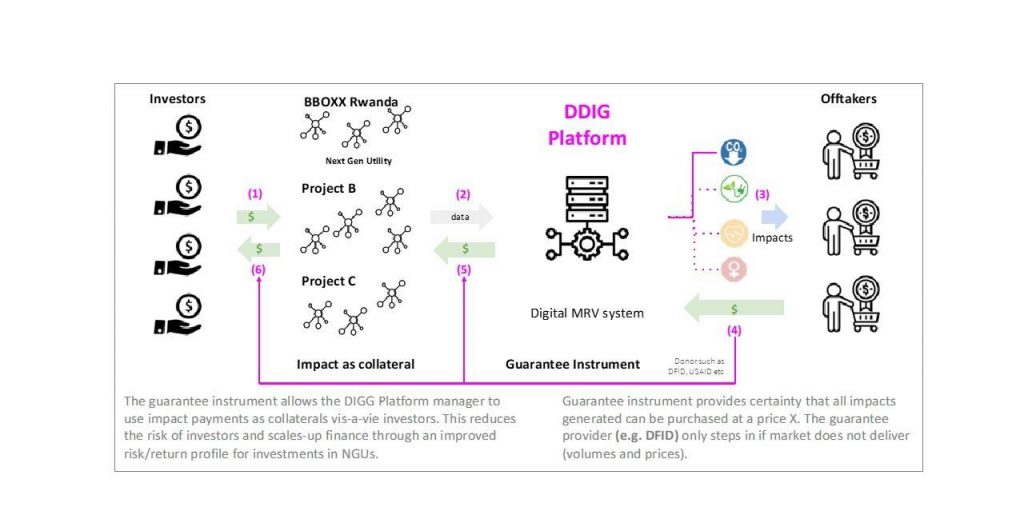

Through a programmatic approach that is carefully governed and enhanced by blockchain technology, we see the opportunity to unlock climate finance at scale, and even further by monetising the SDG’s “Beyond Carbon”[6] value, such as energy access and health improvement. The approach can be accelerated by a governmental/public financial support. It should not be a one-off subsidiary which will distort the carbon market as well as the underlying distributed energy business but an outcome-based finance alongside investors of emission reduction activities, which plays a catalytic role for this new approach toward climate finance for distributed energy and other activities.

A Proof of Concept: Implementation and Learnings

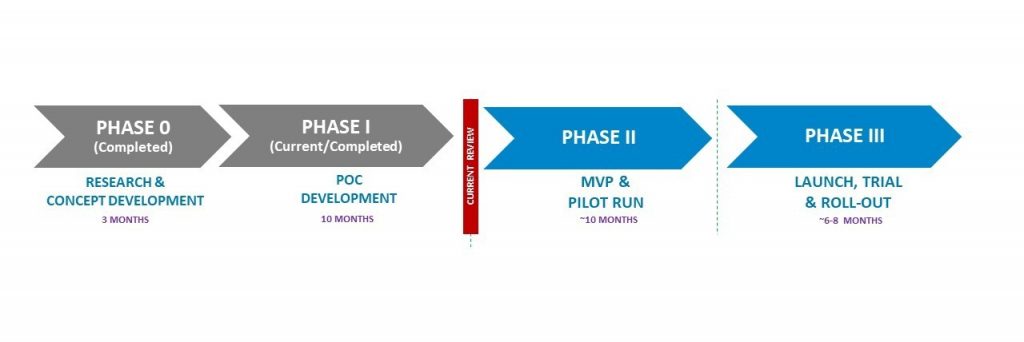

In order to test the DDIG approach, the joint team designed and implemented a proof of concept (PoC) – which forms Phase I of a broader set of developments which later includes establishing monitoring and verification protocol with the pilot transactions and the full launch at a commercial scale. Conceptual ideas were tested through the initial phase and the key learnings are shared in this article, specific to: a) market mobilisation and governance; b) technology platform development; and c) commercial feasibility of the proposed concept.

A) Climate market mobilisation

Through this PoC, both the supply and demand side of the climate market were examined, with a specific energy-access sector lens. Engagements were held with the standards bodies, a dozen of potential off-takers (demand-side), and with the off-grid DRE sector participants (supply-side) – consisting of the Solar Home Systems (SHS), mini-grids, Solar Irrigation, LPG clean cooking and other players. Most of those across the supply and demand side revealed a definite willingness and enthusiasm for participation in the forward-looking climate market mechanisms that links SDG7 with SDG13 goals. However, most also expressed the need for a trusted structure to market and execute such projects.

Climate finance has to date focused on carbon emissions which have been traded through various instruments including: a) Renewable energy certificates (RECs); or b) Carbon offsets (displacement of tC02) in the compliance and voluntary markets.

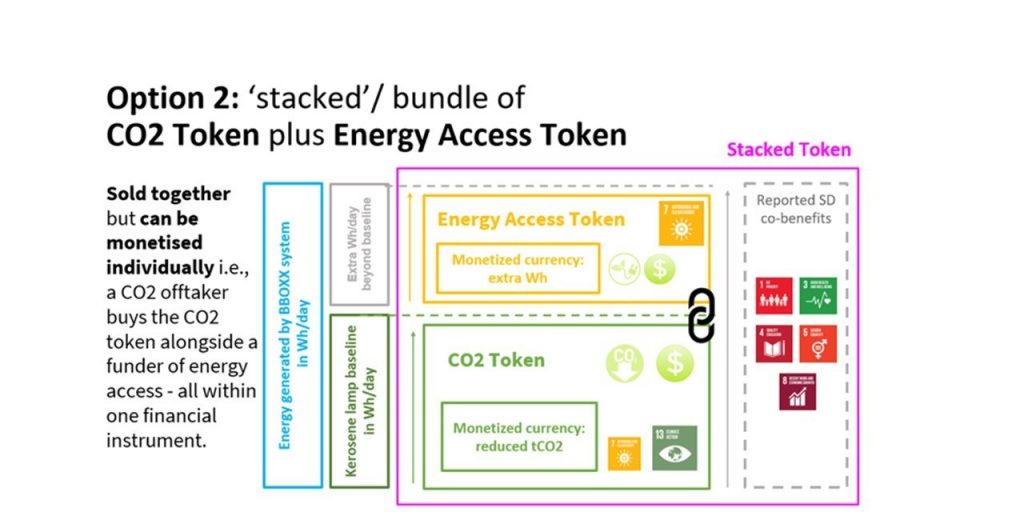

The most commonly traded product in climate markets today is the latter carbon offset. Whilst carbon offset is monetised currently, it is also possible to reference, and measure other SDG related attributes, such as energy access, health, education etc. These could be bundled together, or monetised individually, and the provenance of such transactions can be maintained through digital traceability. RECs serve an interesting alternate climate product, and are growing in popularity, especially with corporates in the USA. These markets are expected to grow significantly as organisations look for renewable sources of power to cover their operating footprint.

Whilst non-regulated schemes exist (do-it-your-self approaches) and are growing in popularity, most compliance or voluntary market participants where high volumes are traded require an instrument certified by a standards body. This was a limiting factor in this work where almost all off-takers required certification to be able to engage. At present, programmes for high-volume, distributed energy schemes are very limited. Standards bodies such as Gold Standard, Verra and VCS seek collaboration to revise their standards to facilitate such projects and a digital approach. It is recommended to engage with these organisations in the next phase to formalise development of these standards, integrating a digital approach.

The proposed concept has the potential to also go beyond current climate finance by inclusion of outcomes-based approaches. For example, results-based finance, and more recently subsidies, are gaining increasing attention in the off-grid SHS and mini-grid sectors. Through the creation of a reference standard that is digital and thereby traceable, there is also the potential to transform the delivery of outcomes-based funding. This would require corporation between private companies, DFIs and governments, and there are early signs of progress.

As an example, in 2019 the government of Togo launched an innovative subsidy model by contributing a proportion of payments an SHS customer is required to pay in its CIZO programme. FONERWA, the Rwandan green fund, has expressed keen interest to further develop and support the outcomes of this project. Furthermore, the UK Government’s FCDO has been developing an outcome-based fund.

To advance this concept further, a governance structure may need to be established to coordinate and manage the development activities across a wide network of stakeholders. It should be implemented through a consortium with various stakeholders and strong governance for public good. To create a functional framework and run a pilot trade, a tangible business case is required and it needs to be endorsed by the host government to ensure genuine impact to the quality of life in the country. The consortium will also call on other SHS players to obtain an industry-wide view on the design of the programme.

B) Technology Working Prototype (Blockchain-based)

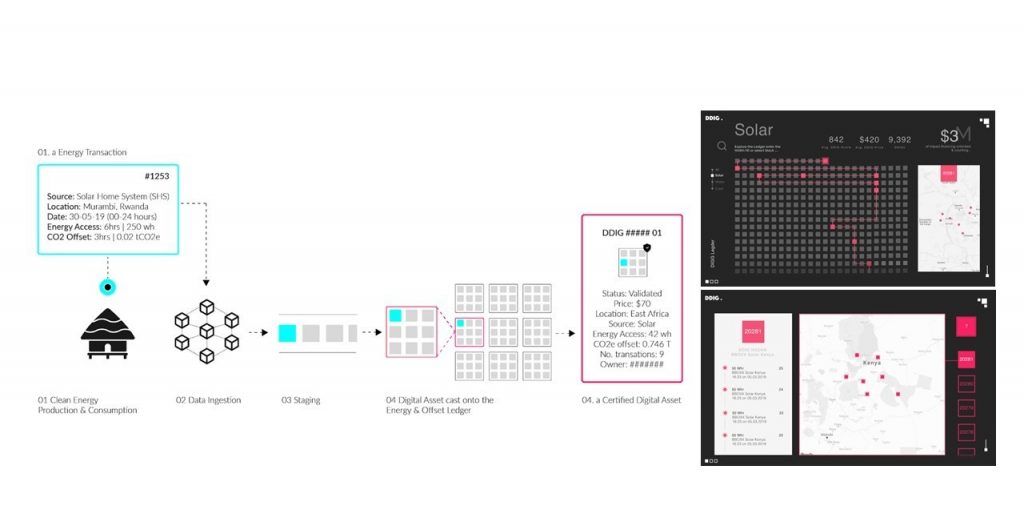

As a part of the PoC, sample IoT data streams from Bboxx’s product installations were published onto a blockchain, proving that it is technically feasible to implement a distributed ledger approach to the digital MRV (Monitoring, Reporting & Verification) process. Parameters such as voltage and current were used to calculate the actual energy consumed, and thereby derive a value of impact that could be verified, then traded..

Blockchain technology offers the ability to maintain a tamper proof (immutable) history of an asset and its transactions. Such technology is vital for building trust in a digital DDIG asset that can be traded. Through blockchain, an automated process can be developed, thereby overcoming the difficulty of current manual MRV processes. It is a powerful example of how technology can be used to verify, and virtually aggregate several distributed energy assets efficiently. At the same time, careful consideration of the technology application are required to minimise cost and energy intensity to manage transactions. Design decisions to build an effective platform in the upcoming phase (detailed later) will require the buy-in from standards bodies and the off-takers to further leverage the use of blockchain technology and IoT data streams to clearly define and transact different impacts on a platform, towards SDG7 linked to SDG13 impact goals.

C) Commercial feasibility analysis

Commercial feasibility was tested by considering the model in Fig 7. In the current voluntary carbon markets, the price of carbon offset is lower than the compliance tool in the compulsory markets, and one might fear there would be an over-supply if the platform encourages more projects. The reality is there is an increasing demand through global climate change initiatives, and the hypotheses is that it requires a framework and platform (such as DDIG) which could bring to the market-trusted projects that are verified and with high impact, and which could also potentially enhance the existing outcome-/results-based financing (RBF) programme. Following is a summary of the key learnings and concept development:

- Considering a baseline of carbon emission, each solar home systems generate small offset value (e.g. estimate 0.1 tCO2 per 50W SHS), translating into $2-3/installed SHS/year in an upper side scenario of the voluntary carbon market.

- Other sectors, for example clean cooking, derive $3-6/instalment/year since they provide higher displacement value from fossil fuels.

- If these values are not considered powerful enough to improve affordability of households, it is possible to stack values of carbon and other impact such as energy access for price enhancement and DDIG will form a platform to help combine such values to enhance offset price.

- Since DDIG is an open structure to accommodate a large number of projects to increase the renewables ‘supply’ volumes, market mobilisation is possible within the PAYG SHS sector itself (with initial focus on connected devices segment), given its considerable growth over the years (~60% CAGR of unit , 2010-17)[7].”

Next Steps: Phase Two – ‘DRECs’ market instrument design and implementation

Further collaboration, support, and advocacy is required – and is being mobilised – to transition from first phase learnings and prototype to a broader implementation programme in a soon to be launched Phase Two. A ‘TaskForce’ has been formalised to lead this programme phase, which would attempt to: a) create a new or customise an existing market instrument for the RECS market for the DRE sector – coined as the Distributed Renewable Energy Certificates or the D-RECs; b) develop new financing mechanisms and a digitised tracking and traceability platform and process (MRV) suited for the DRE players; and c) execute an actual transaction between off-taker(s) in discussion and the DRE player(s) – across the off-grid PAYG SHS, mini-grid developers, productive-use energy et al sector.

Initial estimations indicate that this D-RECs market mechanism could unlock ~$100m/year of totally new climate financing for the DRE sector by 2024, if it picks up as designed

In order to achieve the above goals, the D-RECs TaskForce aims to shape up and execute on the following programme sub-components, engaging on with a broad set of stakeholders and supported via a clear market-neutral governance structure for a sector-wide benefit:

- Standards development: Lead a rapid and focused multi-focused stakeholder consultative process to design and deliver appropriate standards and market instruments for digitization, quantification and certification of distributed renewable energy.

- Financial structuring: Explore a range of commercial and financial models that leverage the new market instrument(s) and drive improved unit economics and/or attract new sources of investment capital into the energy access sector – including paving the way for enhance Results Based Financing (RBF), subsidy models, outcomes tracking beyond environmental attributes.

- Technology platform development: Building on the last PoC, explore a range of existing technology platforms for remote monitoring, digitization, tracking and certifying of the distributed renewable energy assets.

- Advocacy and market development: Engage with influential pledging platforms and industry associations (e.g. RE100.org, REBA, SEforAll, GOGLA, etc.) to promote new opportunities for sourcing and investing into energy access.

- Pilot project execution: Facilitate connections among existing market actors and attract new corporate buyers of RE; demonstrate the potential by developing a specific pilot with a defined market transaction.

As Phase Two gears-up for the launch in the near future, the D-RECs TaskForce team welcomes inputs and participation interest from the off-grid renewable energy players, climate action donors/funders, corporates’ sustainability teams/off-takers and other stakeholders involved in the climate finance ecosystem – towards catalysing and shaping up a potentially new market disruption.

Team Credits

Bboxx (Carrie Scott, Tamara Giltsoff, Norio Suzuki, Anshul Patel); Shell Foundation (Ashish Kumar); SouthPole (Gian Autenrieth, Patrick Bürgi); IBM (Rachel Tabb, Amardeep Rai); Positive Capital (Paul Needham)

For more information please contact: a.patel@bboxx.co.uk, ash.kumar@shellfoundation.org

[1] Lighting Global (World Bank) Estimates, 2020 (https://www.lightingglobal.org/resource/2020markettrendsreport)

[2] Catalyst Off-grid Advisors/SF, 2017 https://sf.briteweb.com/learning/achieving-sdg-7-the-need-to-disrupt-off-grid-electricity-financing-in-africa/

[3] ICAP Emissions Trading Report, 2019 https://icapcarbonaction.com/en/?option=com_attach&task=download&id=614

[4] The Voluntary carbon market includes all the transactions of carbon offsets that are not purchased with the intention to surrender into an active regulated carbon market. Whereas the Compliance carbon markets are marketplaces through which regulated entities obtain and surrender emissions permits (allowances) or offsets in order to meet predetermined regulatory targets (such as under UN’s Clean Development Mechanism).

[5] WB State & Trends of Carbon Pricing, 2019 (http://documents.worldbank.org/curated/en/191801559846379845/State-and-Trends-of-Carbon-Pricing-2019)

[6] TPI Maximising the impact of partnerships for the SDGs, 2018. (https://sustainabledevelopment.un.org/content/documents/2564Maximising_the_impact_of_partnerships_for_the_SDGs.pdf)

[7] GOGLA Off-Grid Solar Market Trends Report, 2018. https://www.gogla.org/sites/default/files/resource_docs/2018_mtr_full_report_low-res_2018.01.15_final.pdf)