As part of the POWERED programme, co- funded with UK aid from the UK government, SF is supporting the Council on Energy, Environment and Water (CEEW) to integrate technical and financial assistance towards gender-inclusion in India. This study overview appeared originally on CEEW’s website.

As part of the POWERED programme, co- funded with UK aid from the UK government, SF is supporting the Council on Energy, Environment and Water (CEEW) to integrate technical and financial assistance towards gender-inclusion in India. This study overview appeared originally on CEEW’s website.

Overview

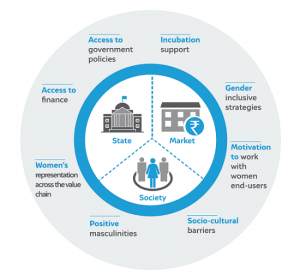

The study discusses the barriers faced by women micro-entrepreneurs, who are using clean energy-powered livelihood technologies, in accessing finance and policy support. It highlights the potential opportunities for integrating women into the renewable energy ecosystem. It examines how businesses can be scaled up to ensure greater participation of women as entrepreneurs, value chain partners, employees and customers. It details solutions and recommendations for a range of stakeholders (donors, policymakers, financiers, incubators and enterprises) who could help women scale up the use of renewable energy powered livelihood technologies in their businesses.

Barriers and opportunities for women-led micro-enterprises

Source: Authors’ compilation

Key Findings

- Women have been involved in the clean energy sector in three areas: 1) Women founders leading enterprises that offer energy products and services; 2) women who work as employees or value chain partners in renewable energy enterprises; and 3) women who lead micro-enterprises that are end-users or customers of energy products and services across sectors.

- Renewable energy enterprises predominantly use two business approaches – product based and value chain based – to reach women micro-entrepreneurs.

- Women-led micro-enterprises need access to productive and clean energy equipment to mechanise operations. About 39% of women micro-entrepreneurs do not own any physical assets and 14% of women micro-entrepreneurs reported that machines used in their businesses were the first and only asset they owned.

- Women experience a greater overlap between their personal and professional responsibilities due to gender division of roles in society, whether they join the workforce for employment or choose self-employment. About 97% of women micro-entrepreneurs reported an increase in the number of hours they spent on household and caregiving responsibilities since the pandemic and around 65% relied on family members to make business decisions.

- Roughly 54% of women-led micro-enterprises are unregistered. The financial system makes it challenging for women to access loans in the first place due to the requirement of registration, collateral, margin money, and trust deficit in their loan repayment capacity. Lack of knowledge and confidence among financiers to finance energy products also pose a challenge.

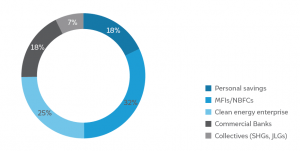

Loans and clean energy enterprises are the primary source of financing to use DRE-powered products

Source: CEEW analysis; Data: CEEW microentrepreneur analysis. Sample size: 28

- Women micro-entrepreneurs have limited awareness about existing government policies, particularly for energy products and programmes, and how to avail them. Government policies and schemes may be gender-inclusive by design, yet implementation procedures are gender blind.

Key Recommendations

Investors and donors

- Encourage and support project and programme design to integrate gender analysis and a strong gender lens during conceptualisation of business, projects and programmes.

- Mainstream gender lens ecosystem building activities such as entrepreneurship development programmes, technical assistance to start-ups, research and advocacy.

- Invest in financial institutions lending to women especially in those that can meet their asset acquisition needs.

- Support and build capacity of policymakers and implementation officials to design and implement schemes with a gender lens.

Policymakers

- Include capital subsidy for mechanisation of women’s activities across all sectors through existing schemes in agriculture, MSMEs, textiles, food processing and other sectors that have a large share of women workers.

- Mainstream gender-inclusive policy targets and gender-responsive budgeting in the energy ministries.

- Launch schemes supporting renewable energy technologies (especially in non-traditional sectors) with targeted support for women.

- Extend social safety net support for self-employed workers; tax incentives to start-ups for the development of childcare infrastructure; interest breaks during pregnancy and early childcare to avoid double burden on women.

Financial Institutions

- Enable credit through incentives, alternative credit assessment methods, and leveraging the microfinance institutions and collectives’ credit history.

- Customise loan products accounting for women’s needs and increase focus on lending to women in partnership with women’s organisations.

- Increase the pipeline of women customers along with improvement in gender ratio and sensitisation of staff.

Entrepreneurship Development Programmes

- Ensure targeted support for women-led micro-enterprises for services such as registration, documentation, and access to credit.

- Bridge information asymmetry and facilitate access to government schemes and policies for women entrepreneurs.

- Facilitate sessions for women micro-entrepreneurs through mentors to navigate the process of accessing various kinds of support.

- Go beyond skills training to mainstream empowerment, agency and negotiation of social norms for women entrepreneurs (and sensitisation of men on these aspects).

Clean Energy Enterprises

- Act as aggregators of loan demand for financial institutions and enable end-user financing for their customers.

- Provide margin money assistance or financing through a revolving fund supported by profits or philanthropic capital.

- Bring in a gender lens in designing business strategy around sales, marketing, recruitment and capacity building.

- Engage with families and social norms to design a gender transformative business model, with help with partners, donors and investors.