Mini-grids are essential to the United Nations Sustainable Development Goal 7 (SDG 7), which aims to provide universal access to affordable, reliable, sustainable and modern energy by 2030. In order to achieve this goal, 238 million households will need to gain access to electricity.

It is estimated that mini-grids can serve nearly half of these households, and are often the lowest-cost form of electrification for off-grid populations. This would require $128bn in mini-grid investments over the next 10 years.

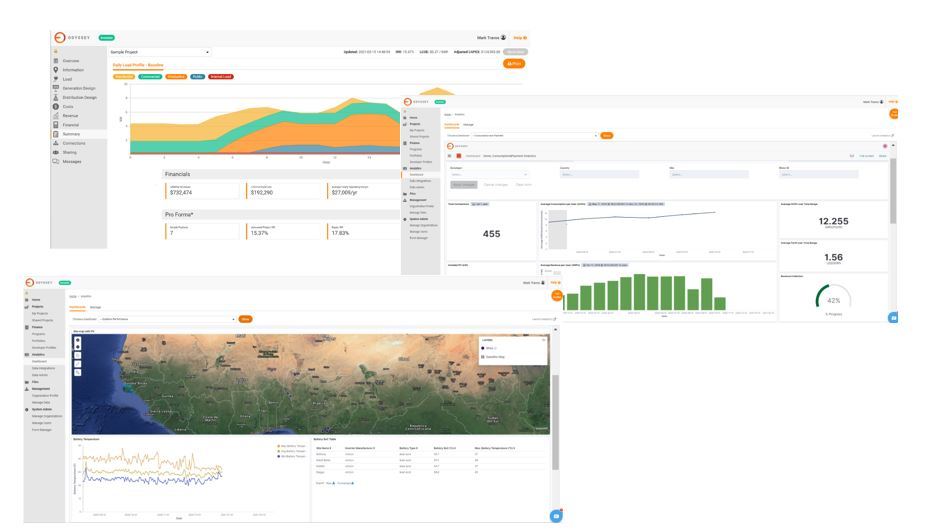

In early 2019, Odyssey embarked on a partnership with CrossBoundary Energy Access (CBEA), the first mini-grid project finance vehicle in Africa, to develop the technology platform required to accelerate mini-grid finance. The project was funded by Shell Foundation, the UK Foreign, Commonwealth & Development Office (FCDO) and the OPEC Fund for International Development.

The purpose of this report is to share some of the key learnings the team has gained while developing the sector’s first mini-grid investment platform, namely that:

- To build bankable mini-grid portfolios, investors need advanced data technologies that pull reliable insights from challenging data sets;

- Solidifying KPIs is key to developing data technologies tailored to mini-grid investments;

- To make financial transactions viable for the mini-grid sector, new document management technologies are essential.

Download the full report (pdf, <1mb)